CFOs at the Helm: Mastering the Art of Budgeting in Turbulent Times

The role of Chief Financial Officer (CFO) is critical in any organization, but in an uncertain economic environment, their responsibilities become even more crucial. CFO's must navigate budgeting amid economic unpredictability and ensure financial stability through effective financial planning and risk management strategies.

In such situations, CFO's must analyze financial data, evaluate business operations, and make informed financial decisions that align with the organization's goals. CFO's budgeting in an uncertain economic environment requires a combination of expertise, experience, and financial acumen.

Key Takeaways

CFO's budgeting in an uncertain economic environment involves managing budgets amidst economic unpredictability.

Effective financial planning and risk management strategies are crucial for CFO's to ensure financial stability.

Accurate financial forecasting provides insights for effective budgeting and risk management.

Strategic budgeting approaches such as zero-based budgeting and rolling forecasts are crucial in uncertain economic times.

Effective communication with stakeholders and continuous monitoring and review of budget performance are vital for successful CFO's budgeting.

Understanding the Role of a CFO in Budgeting

Effective budgeting is crucial for the financial stability and success of any organization. As a key member of the executive team, the Chief Financial Officer (CFO) plays a critical role in the budgeting process. The CFO's primary responsibility is to ensure that the budget aligns with the company's overall financial goals and objectives.

The CFO's role in budgeting involves overseeing the financial management of the organization and making strategic financial decisions. This includes identifying and managing financial risks and opportunities, monitoring financial performance, and providing recommendations for improving financial outcomes.

In addition to financial management, the CFO is also responsible for overseeing the entire budgeting process, from planning and preparation to implementation and review. This involves collaborating with other executives, department heads, and stakeholders to develop a budget that aligns with the company's strategic goals and objectives.

The CFO also plays a critical role in ensuring that the budget is flexible and adaptable to changes in market conditions and economic factors. This requires ongoing monitoring and review of budget performance and making necessary adjustments to ensure that budget goals are met.

Key Responsibilities of a CFO in Budgeting

Some of the key responsibilities of a CFO in budgeting include:

Developing financial plans and budgets that align with organizational goals and objectives

Providing financial insights and recommendations to other members of the executive team

Identifying and managing financial risks and opportunities

Implementing financial controls and procedures to ensure compliance with regulatory requirements

Monitoring financial performance and making necessary adjustments to ensure budget goals are met

Communicating financial information and budget plans to stakeholders

The CFO's role in budgeting extends beyond just managing the financials. It involves being a strategic partner to other executives, providing insights and recommendations that can help drive the company's overall performance. This requires a deep understanding of the company's operations, competitive environment, and financial landscape.

"The CFO's role in budgeting involves overseeing the financial management of the organization and making strategic financial decisions."

Overall, the CFO's role in budgeting is critical to the financial success of the organization. By providing financial insights, managing financial risks, and ensuring that budget plans align with organizational goals, the CFO can help drive the company's financial performance and position it for long-term success.

The Impact of Economic Uncertainty on Budgeting

Economic uncertainty can significantly affect budget planning and execution for CFOs. Market volatility, changes in consumer behavior, and unpredictable geopolitical events can make it difficult to create accurate and dependable budget plans. The impact of economic uncertainty can manifest in various ways, including:

Delayed or canceled investments and projects

Reduced revenue and profitability

Cost overruns and higher expenses

Decreased liquidity and financial stability

To mitigate the impact of economic uncertainty on budgeting, CFOs must adopt flexible budgeting strategies that can adjust to market turbulence and changing circumstances. These strategies include:

Rolling forecasts: Rather than using a static, yearly budget plan, CFOs can create rolling forecasts that update regularly to reflect the latest market outlook. Rolling forecasts can help companies make timely and informed decisions about resource allocation and investment opportunities.

Contingency planning: CFOs can also create contingency plans that outline potential responses to different economic scenarios. This can help companies prepare for unexpected events and minimize negative impacts on financial performance.

Scenario analysis: CFOs can use scenario analysis to model the potential impact of different economic scenarios on financial performance. This can help companies identify opportunities and risks and inform decision-making.

By adopting flexible budgeting strategies and mitigating the impact of economic uncertainty, CFOs can ensure their companies remain financially stable and resilient in the face of unpredictable economic conditions.

Financial Forecasting in an Uncertain Environment

Financial forecasting is a critical aspect of budgeting that enables CFOs to make informed decisions that align with their organizations' strategic objectives. The practice involves analyzing historical financial data to create a projection of future financial performance. However, in uncertain economic environments, forecasting can be challenging due to the unpredictability of market conditions and economic factors.

Despite the uncertainty, CFOs must ensure that their financial forecasts are accurate and reliable to facilitate effective budgeting and risk management strategies. To achieve this, CFOs must adopt specific forecasting techniques tailored to the current economic climate. These techniques include scenario planning, sensitivity analysis, and prediction markets.

The Role of Financial Forecasting in Risk Management

Financial forecasting plays a crucial role in risk management as it helps CFOs identify potential risks and opportunities. By analyzing financial data, CFOs can identify trends, market patterns, and other factors that may affect their organizations' financial stability. This insight enables them to make informed decisions that mitigate risks and capitalize on opportunities.

For example, suppose a CFO notes that their organization's sales performance is declining due to increased competition. In that case, they can use financial forecasting to analyze the market trends and develop strategies that align with their organization's strategic objectives. This proactive approach can help mitigate the financial risks associated with declining sales and maintain financial stability.

The Importance of Accurate Forecasting

It is crucial to note that financial forecasting is only effective if it is accurate. Inaccurate forecasting can lead to incorrect predictions, resulting in ineffective budgeting and risk management strategies. Therefore, CFOs must use reliable data sources and employ robust forecasting models to ensure that their financial forecasts are accurate.

CFOs can further improve the accuracy of their financial forecasts by incorporating data analytics and machine learning techniques. These tools provide CFOs with deeper insights into their financial data, enabling them to identify trends, forecast outcomes, and make data-driven decisions that align with their organizational goals.

The Benefits of Financial Forecasting

The benefits of financial forecasting in uncertain economic environments are numerous. First, financial forecasting allows CFOs to identify potential risks and opportunities, enabling them to make informed decisions that align with their organizational goals. Second, accurate financial forecasting can improve financial stability and facilitate effective budgeting and risk management strategies.

Additionally, financial forecasting improves communication between CFOs and other stakeholders. By projecting future financial performance, CFOs can create a shared understanding of their organization's financial goals and establish accountability for budgeting decisions.

Overall, financial forecasting is a critical component of effective budgeting and risk management strategies in uncertain economic environments. By adopting reliable forecasting techniques and using data-driven insights, CFOs can navigate economic unpredictability and achieve financial stability.

Strategic Budgeting Approaches for CFOs

As CFOs navigate budgeting in an uncertain economic environment, strategic budgeting approaches can offer valuable guidance. By employing effective budgeting techniques, CFOs can mitigate financial risks, optimize cost efficiency, and align budget plans with organizational goals. Here are some common strategic budgeting approaches to consider:

Zero-Based Budgeting

Zero-based budgeting involves creating a new budget from scratch each year, with no reference to prior budgets. This approach requires a thorough examination of every expense, ensuring that each item justifies its inclusion in the budget. By identifying areas of inefficiency and allocating resources based on priority, CFOs can optimize spending and reduce waste.

Activity-Based Budgeting

Activity-based budgeting involves identifying the key activities that drive the company's financial performance and creating a budget plan around those activities. By aligning budget decisions with the company's operational goals, CFOs can ensure that budget plans support the strategic direction of the company.

Rolling Forecasts

Rolling forecasts involve updating the budget plan regularly based on the latest financial information. Rather than setting a strict annual budget, this approach allows for flexibility and adaptation to changing economic conditions. CFOs can use rolling forecasts to quickly adjust budget plans in response to new information and minimize the impact of economic uncertainty on financial stability.

Cost-Benefit Analysis

Cost-benefit analysis involves weighing the costs of implementing a particular project or initiative against the expected benefits. By evaluating the potential return on investment, CFOs can make informed decisions about budget allocation and prioritize initiatives that offer the highest ROI.

Value-Based Budgeting

Value-based budgeting involves focusing budget decisions on the value that each item adds to the company. Rather than prioritizing expenses solely based on cost, this approach considers the potential return on investment and the strategic importance of each expense. CFOs can use value-based budgeting to ensure that budget plans align with the company's overarching goals and prioritize initiatives that offer the greatest value.

By adopting strategic budgeting approaches, CFOs can navigate the challenges of budgeting in an uncertain economic environment and ensure financial stability for their organizations.

Aligning Budgeting with Organizational Goals

Effective budgeting should align with the strategic objectives of the organization. CFOs should ensure that budget plans support the company's long-term vision and drive financial performance. To achieve this, CFOs need to establish a clear understanding of organizational goals and their financial implications.

One technique that can help align budgeting with organizational goals is performance-based budgeting. This approach ties budget allocations to specific performance goals and metrics. By focusing on performance, CFOs can ensure that resources are allocated in a way that supports the company's strategic objectives.

Performance-Based Budgeting Example

For example, let's say a company has a strategic objective of increasing market share by 5% over the next two years. To support this goal, the CFO could allocate resources to marketing and sales initiatives that are expected to drive customer acquisition and retention.

By aligning budgeting efforts with organizational goals, CFOs can demonstrate the value of financial planning and showcase their role in driving strategic growth.

Another approach to aligning budgeting with organizational goals is to involve key stakeholders in the budgeting process. By soliciting input from different departments and executives, CFOs can gain insights into the resources and funding needed to support specific projects and initiatives. This collaborative approach can also foster a sense of ownership and buy-in from stakeholders who are invested in achieving the company's strategic objectives.

Overall, CFOs play a crucial role in ensuring that budgeting efforts support the growth and success of the organization. By aligning budget plans with organizational goals and involving stakeholders in the process, CFOs can drive financial performance and demonstrate their strategic value to the company.

Risk Management Strategies for Budgeting

Uncertain economic environments can expose companies to various risks, making risk management an essential aspect of CFO's budgeting. CFOs need to identify potential risks, assess their impact on the financial stability of the company, and implement strategies to mitigate their negative effects. Effective risk management can prevent financial losses and improve the company's ability to withstand economic shocks, making it an imperative aspect of successful budgeting and financial planning.

One strategy that CFOs can implement is scenario analysis, which involves identifying potential scenarios that could impact the company's financial stability and evaluating their likelihood and impact. This approach allows CFOs to assess potential risks and develop contingency plans to address them.

CFOs can also implement contingency planning, which involves developing a plan of action to respond to potential risks. This includes identifying critical business functions, establishing alternative plans, and allocating resources to mitigate losses.

Diversification is another risk management strategy that CFOs can utilize in budgeting. The approach involves investing in a range of assets and markets to spread the risk evenly and minimize losses in case of economic volatility.

To ensure comprehensive risk management, CFOs should also consider creating a risk management committee comprising representatives from various departments to assess and mitigate risks holistically.

Implementing Risk Management Strategies

Implementing risk management strategies requires a dedicated budget allocation to cover the cost of risk identification, assessment, and mitigation. CFOs should draft a separate budget for risk management, ensuring that resources are available to implement the necessary strategies to mitigate risks successfully.

Furthermore, implementing risk management strategies requires cooperation and buy-in from all stakeholders. CFOs should communicate the risks and potential impact to stakeholders, emphasizing the need to implement the proposed risk management strategies to maintain financial stability.

In conclusion, effective risk management is essential for CFO's budgeting in uncertain economic environments. Implementing strategies such as scenario analysis, contingency planning, diversification, and establishing risk management committees can mitigate risks, prevent losses, and improve the company's financial stability.

Data-Driven Budgeting Decisions

In an uncertain economic environment, CFOs must leverage financial insights and data analytics to make informed budgeting decisions. With accurate data, CFOs can identify potential financial risks and opportunities, and allocate resources effectively to optimize financial performance.

By analyzing historical financial data and identifying patterns, CFOs can forecast future performance and adjust budget plans accordingly. This helps ensure that the organization has the necessary resources to achieve its financial goals and mitigate financial risks.

In addition to historical financial data, CFOs can also utilize real-time financial data to make informed budgeting decisions. This includes data from financial systems, sales reports, and market trends. By analyzing real-time data, CFOs can make quick decisions to adjust budget plans and ensure that the organization remains agile in response to economic changes.

Utilizing Financial Technology

To enable data-driven decision-making, CFOs can leverage financial technology such as enterprise resource planning (ERP) systems and financial analytics tools. These tools can help CFOs track financial data in real-time, automate financial processes, and provide advanced financial insights to support decision-making.

For example, ERP systems can provide a comprehensive view of financial data, including cash flow, revenue, and expenses. This helps CFOs track budget performance in real-time and identify areas for optimization.

Financial analytics tools can also provide CFOs with advanced financial insights, such as predictive analytics and scenario analysis. Predictive analytics can help CFOs forecast future financial performance, while scenario analysis can help CFOs identify potential financial risks and opportunities.

Importance of Accurate Data

Data-driven budgeting decisions are only as effective as the quality of the data being analyzed. CFOs must ensure that the data being used for decision-making is accurate, complete, and up-to-date.

This requires maintaining accurate financial records and implementing data governance policies to ensure data accuracy and consistency. It also requires collaborating with other departments in the organization to ensure that data is being collected and analyzed in a standardized way.

key takeaway

In an uncertain economic environment, data-driven decision-making is critical for effective budgeting. By leveraging financial insights and data analytics tools, CFOs can make informed decisions that support financial stability and growth. However, it is essential to ensure that the data being used for decision-making is accurate and up-to-date to maximize the effectiveness of data-driven budgeting strategies.

Cost Optimization and Efficiency Measures

Financial management is crucial in navigating uncertain economic environments. CFOs must be proactive in implementing cost optimization and efficiency measures to ensure financial stability. In this section, we will explore some budgeting techniques that CFOs can use to achieve cost optimization and efficiency, including cost-cutting initiatives, process improvements, and resource allocation.

Cost-cutting Initiatives

Cost-cutting initiatives are a common approach to achieving cost optimization. CFOs can implement various cost-cutting measures, such as reducing discretionary expenses, renegotiating contracts, or rationalizing product lines. These measures can not only help to reduce costs but also improve organizational efficiency.

For instance, CFOs can reduce discretionary expenses such as travel expenses, training programs, or outsourcing services. By renegotiating contracts, CFOs can secure better terms and reduce costs. Rationalizing product lines can also help to streamline operations and eliminate unprofitable products.

Process Improvements

Process improvements can also lead to cost optimization and efficiency. CFOs can identify and remove bottlenecks or inefficiencies in the organization's processes, which can help to reduce costs and improve productivity. For instance, CFOs can implement automation, outsourcing, or re-engineering initiatives to streamline processes.

Automation can help to reduce labor costs and improve accuracy. Outsourcing can help to reduce costs and improve efficiency by leveraging external expertise. Re-engineering can help to redesign processes to eliminate inefficiencies and optimize performance.

Resource Allocation

CFOs can also optimize costs by allocating resources effectively. By reallocating resources, CFOs can focus on high-value activities and reduce waste. For instance, CFOs can prioritize projects based on their strategic value and potential return on investment.

CFOs can also implement activity-based costing (ABC), which is a technique that assigns costs to specific activities based on their consumption of resources. This technique can help to identify areas where costs can be reduced or eliminated.

By implementing cost optimization and efficiency measures, CFOs can ensure financial stability in an uncertain economic environment. These measures can help to reduce costs, improve organizational efficiency, and enhance strategic decision-making. In the next section, we will explore the importance of effective communication in budgeting.

Communicating Budgeting Strategies to Stakeholders

Effective communication is crucial to the success of any budgeting strategy. CFOs must ensure that stakeholders understand the rationale and objectives behind the budget plan. Clear and concise communication helps to build trust and support, which is critical for achieving financial stability.

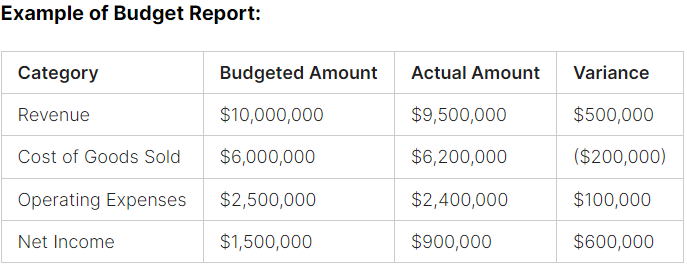

One way to communicate budgeting strategies is to create a budget report. The report should include an overview of the budget plan, key assumptions, and financial projections. It should also highlight any risks and opportunities that may impact the budget plan.

Another way to communicate budgeting strategies is to hold regular meetings with stakeholders. During these meetings, CFOs can present the budget plan and answer any questions or concerns that stakeholders may have. It is also important to listen to stakeholders' feedback and incorporate their suggestions into the budget plan if appropriate.

In addition, CFOs can use visual aids such as charts and graphs to help stakeholders understand complex financial information. Visual aids can make financial data more accessible and engaging for non-financial stakeholders.

Note: The budgeted amount refers to the amount budgeted for the period, while the actual amount refers to the actual amount spent. The variance is the difference between the budgeted amount and the actual amount.

CFOs must also be transparent about any changes or updates to the budget plan. If there are any significant deviations from the original plan, stakeholders must be informed and provided with an explanation for the changes.

Effective communication of budgeting strategies helps to align stakeholders' expectations, gain support, and achieve financial stability.

Monitoring and Reviewing Budget Performance

Effective financial management requires ongoing monitoring and review of budget performance. CFOs should regularly track key performance indicators (KPIs) to evaluate the effectiveness of budgeting strategies and identify any variances.

One essential KPI to monitor is the variance between budgeted and actual expenses. This variance analysis helps CFOs identify areas where actual spending differs significantly from planned spending, allowing them to make necessary adjustments in budgeting strategies. CFOs should also monitor revenue and profit margins to determine if they are meeting or exceeding expectations.

It's crucial for CFOs to report budget performance regularly to stakeholders, including the board of directors, investors, and other executives. Clear and concise reporting is essential to communicate budgeting strategies and financial plans effectively to stakeholders and gain support and alignment.

"Effective financial management requires ongoing monitoring and review of budget performance."

In addition to regular reporting, CFOs should conduct periodic reviews of budget plans and performance, adjusting them as needed to ensure goals are met. By regularly reviewing budget performance and making necessary adjustments, CFOs can improve financial stability and ensure the company's long-term success.

Conclusion

In today's uncertain economic environment, effective budgeting is crucial for the financial stability and success of any company. CFOs play a vital role in managing budgets amidst economic unpredictability, requiring them to employ sound financial planning and risk management strategies. As highlighted in this article, understanding the role of a CFO in budgeting, the impact of economic uncertainty on budgeting, and the importance of financial forecasting and strategic budgeting approaches are key elements in achieving financial stability.

Data-Driven Decision Making

CFOs can leverage data analytics and financial insights to make informed budgeting decisions, improving financial stability and mitigating financial risks. By implementing cost optimization and efficiency measures, monitoring and reviewing budget performance regularly, and communicating budgeting strategies to stakeholders effectively, CFOs can ensure the alignment of budget plans with organizational goals. To conclude, in the face of economic unpredictability, CFO's budgeting in an uncertain economic environment is crucial for the financial success of any organization.